Unbundling Uncovered New York - June 13th

Defining Best Practice in Research Procurement

Research Spend Analytics

Industry first apples-to-apples investment research price benchmarks for research procurement professionals across banks, brokers, independent research providers and experts.

INVESTMENT RESEARCH PRICE BENCHMARKS

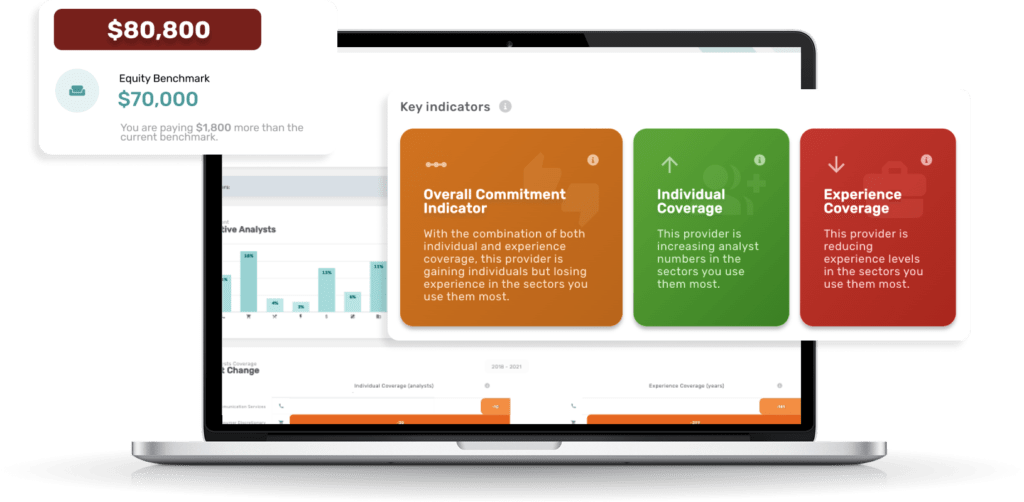

Price Benchmarks providing visibility on research costs per provider vs peers for like-for-like use cases. Gain transparency across investment research spend to optimize decision making and budgets.

ANALYST MAPPING

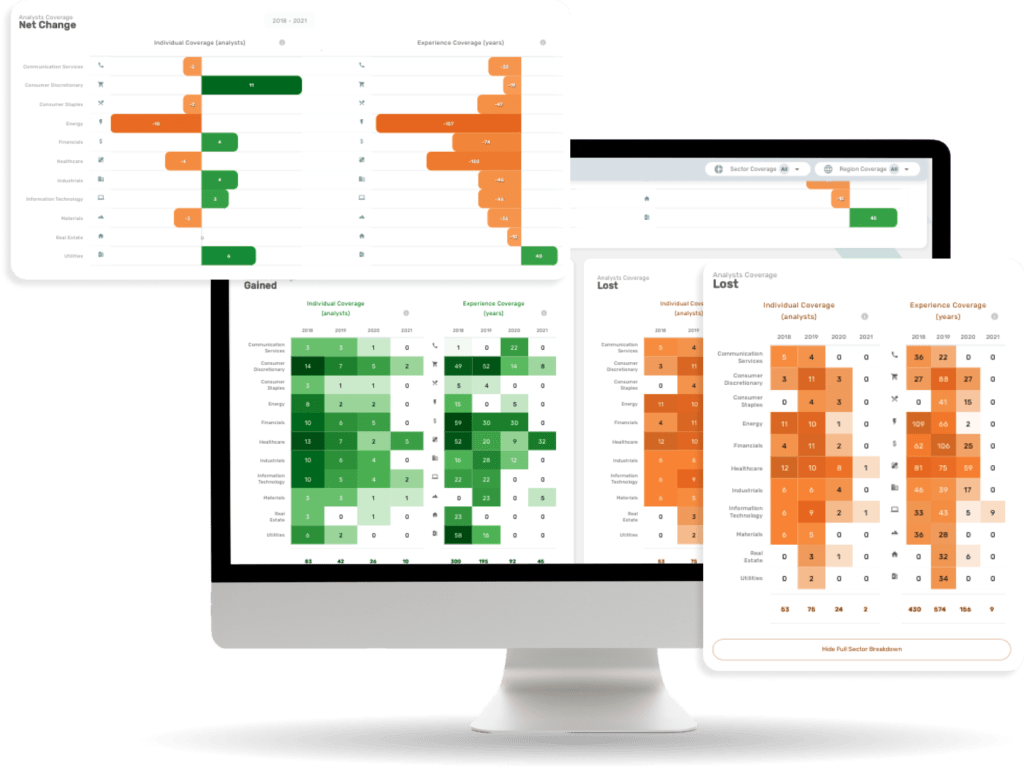

In-depth analysis on providers current and changes in analyst resourcing per sector. Identify gains/losses in their equity analysts’ headcount/experience levels for each of their sector teams, and compare against your areas of consumption per provider.

MARKET TRENDS

Stay on top of major trends across research budgets, payments, changes in market share, analyst interactions, provider resourcing and more to help with decision making and to report back to senior management/clients.

Total Budget Savings

Get Started

Contact us for apples-to-apples benchmarks across your research provider list.

Frequently asked questions

Clients use Substantive to understand how their budgeting and payments to research providers compare vs peers for like for like services. Key benefits include identifying opportunities to cut costs, increase access/service, allocate budget efficiently (and demonstrate this to internal stakeholders) and gain transparency on spend vs the peer group/market.

Substantive’s 100+ clients include asset managers, wealth managers, private banks and hedge funds based 60:40 Europe/North America.

Research Procurement Professionals – gain visibility on research spend vs peers for like for like services in order to budget and negotiate with greater efficiency and success

Finance – external confirmation of budget/spend vs market competitors

Investment Function – increase access/service levels and understand where you sit in the hierarchy of clients for each provider

Compliance – ensure you can demonstrate you are using appropriate levels of research payments for each provider and show that you have engaged external analysis to do so

Your peer group for the analysis accounts for firms of a similar strategy, assets under management, equity/FICC breakdown and regional asset allocation.

At Substantive Research we collate data from the client which allows us to understand and match to specific use cases per provider. This includes information on pricing, product consumption, volume of interactions and user numbers which ensures we capture the particular footprint of the client with each of their providers.

Substantive Research is the only firm with accurate data on research providers’ analyst resourcing, which helps our clients align with providers that are investing within the areas and sectors where they need coverage and insight. It provides a breakdown of the number of existing analysts, the changes in headcount and experience levels in years across sectors (going back to 2017).